how much is tax on food in massachusetts

All restaurant food and on-premises consumption. That statewide tax is currently 625 which is also Massachusetts statewide sales tax rate.

Who Pays Low And Middle Earners In Massachusetts Pay Larger Share Of Their Incomes In Taxes Massbudget

This page describes the.

. The base state sales tax rate in Massachusetts is 625. The Massachusetts income tax rate is. The tax is 625 of the sales price of the meal.

The meals tax rate is. You are able to use our Massachusetts State Tax Calculator to calculate your total tax costs in the tax year 202223. Massachusetts Tax Refund.

The state income tax is charged at a flat rate of 5 and the sales tax is charged at a rate of 625. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. How much is tax on food in Massachusetts.

Groceries and prescription drugs are exempt from the Massachusetts. Monthly on or before the 20th day following the close of the tax period. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant.

The tax is 625 of the sales price of the meal. Payment is made with 1000 in food stamps and 4000 in cash. The purchase included 3800 worth of tax exempt items and 1200 worth of food that may be purchased.

Our calculator has recently been updated to include both the latest. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on. The Massachusetts tax on meals sold by restaurants is 625 this is true for all cities and counties in MA including Boston.

State Auditor Suzanne Bump announced Thursday that. How Much of the 3B State Surplus Could You Get. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

The Massachusetts state sales tax rate is 625 and the average MA sales tax after local surtaxes is 625. Massachusetts has a separate meals tax for prepared food. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

Use tax is a 625 tax paid on out-of-state or out-of-country purchases that are used stored or consumed in Massachusetts and on which no Massachusetts sales tax or less than 625. The meals tax rate is 625. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant.

Sales tax on meals prepared food and all beverages. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1. Details about when and how money will flow back to residents remains unclear one week.

Massachusetts Restaurant Tax. Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. Massachusetts offers tax deductions and credits to reduce your tax liability including.

Massachusetts officials announced last week that 3 billion in surplus tax revenue will be returned to taxpayers. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Thai Noodle Bar Menu In Quincy Massachusetts Usa

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Calculate How Much Your Mass Tax Refund Check Will Be Masslive Com

Kansas Collects 176 3m More Than Expected In April Taxes Kansas Reflector

In Flight Meals Ma Airline Food Catering Companies Ma

Massachusetts Stmab 4 Fill Out And Sign Printable Pdf Template Signnow

Kevin Mass Food Tax Isn T A Math Problem It S A Moral Problem

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

Massachusetts Senate Approves 250 Stimulus Checks For Bay Staters Tax Relief For Renters And Low Income Residents Masslive Com

Massachusetts Gives Shoppers Another Sales Tax Free Weekend Wamc

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

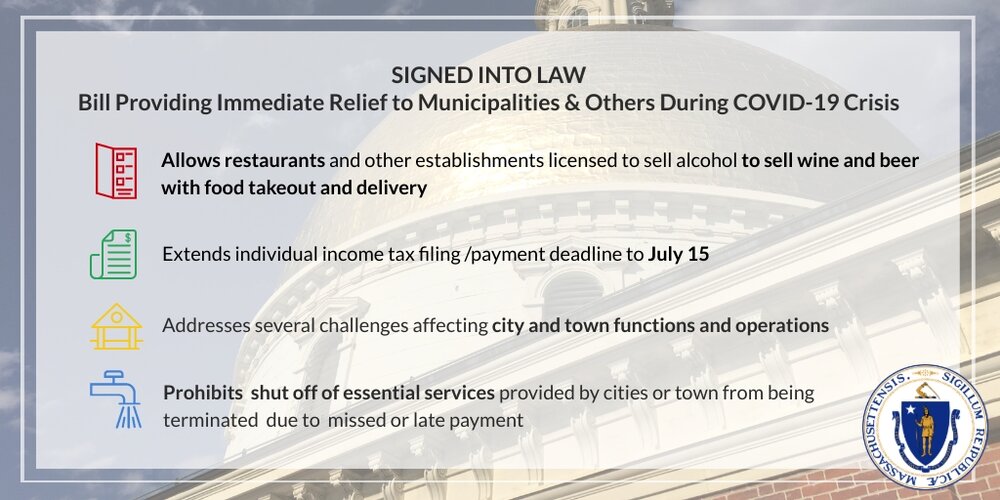

Massachusetts Legislature Passes Bill To Provide Immediate Relief To Municipalities And Others During The Ongoing Covid 19 Crisis Senate President Karen E Spilka